[

] 171

E

nergy

quently skews the abatement opportunities available to

an organisation. A robust approach to carbon manage-

ment typically requires methodical carbon foot-printing,

identification of efficiency opportunities, development of

carbon management plans, implementation of opportuni-

ties, monitoring and reporting progress. These processes

lay beyond the capability of many businesses and the

opportunities therefore often go uncaptured.

The complexity of these tasks highlights the impor-

tance of the Low Carbon Growth Plan as a decision

making framework. For businesses, it can highlight key

areas of opportunity relevant to their sector including

indicative costs and potential financial returns to inform

investment decisions. The diagram over page demon-

strates how the Plan could assist a chemicals company

capture new low carbon growth opportunities. For policy

makers, the Low Carbon Growth Plan provides a clear

understanding of where to direct policy to best enable

businesses to identify and implement emissions reduc-

tion opportunities.

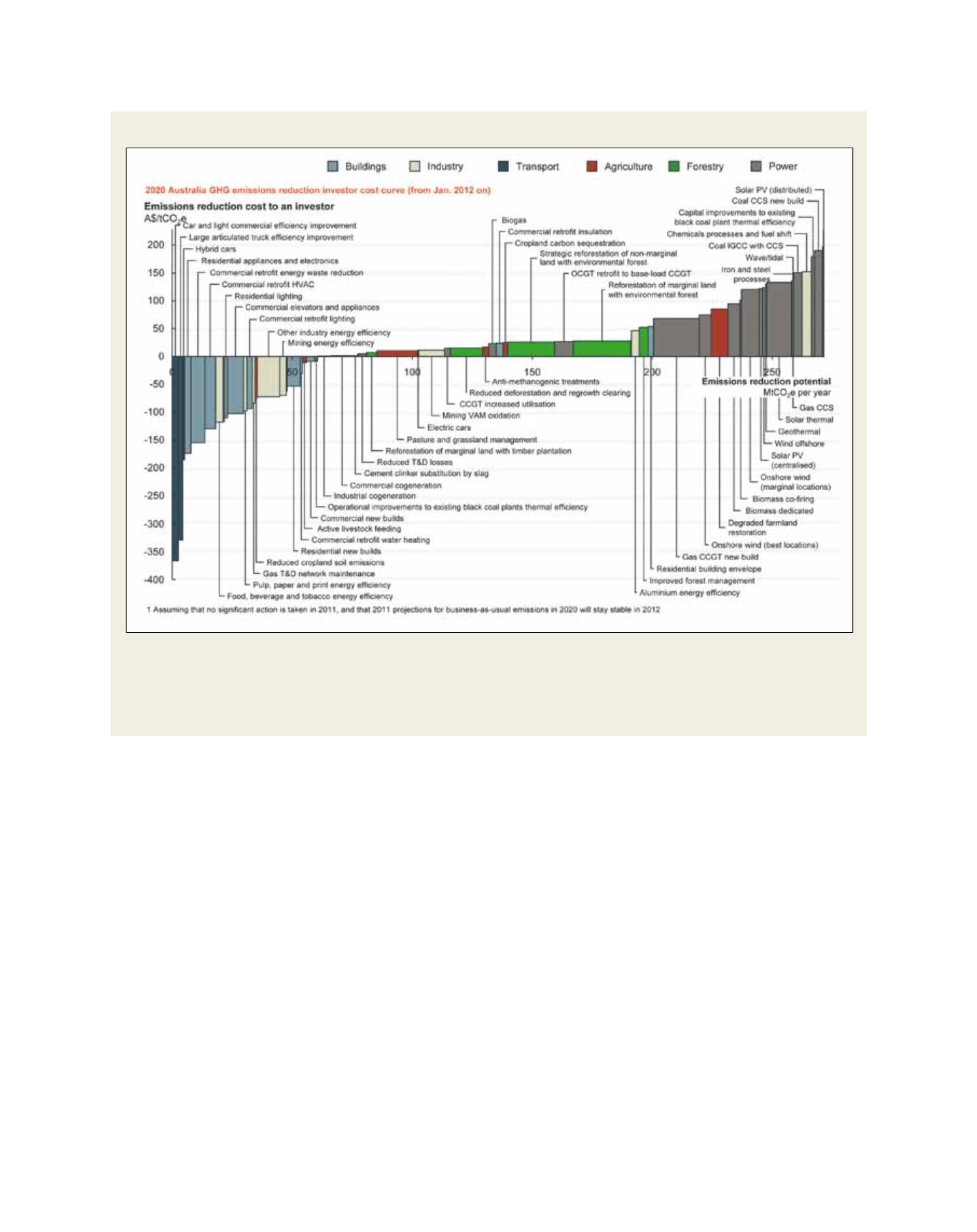

The Plan is unique as each of these 62 opportunities are quantified

and ranked by their relative merit order. These ‘best bang for buck’

opportunities are presented in an emissions reduction cost curve (see

diagram above).

The opportunities focus on current technology or best practice

and emerging technologies expected to be commercially viable by

2020. This is important, as the Plan highlights readily implementable

actions that don’t require technology breakthrough or changes to the

business mix of our economy.

Consequently, the Plan has emerged as a critical tool for business

and government by establishing a clear vision and roadmap to a low

carbon economy. This technically robust and accessible Plan has

helped to bridge the gap between research and action, helping to build

momentum in the business community and identify cost-effective first

steps in the transition to a low carbon future.

What climate services does the Plan offer?

Effective carbon management remains a key challenge for Australian

businesses. Compared with other countries, Australia’s coal-dominated

electricity supply is particularly emissions intensive, which conse-

2020 greenhouse gas emissions reduction investor cost curve (from Jan 2012 on) for Australia

Source: ClimateWorks

How to read an emissions reduction cost curve: Each box on the cost curve represents a different abatement opportunity. The width of each box

represents how many tonnes of emissions can be reduced if there is reasonable uptake of the opportunity across the economy. Added up, the width

of all boxes on the cost curve represents the total volume of abatement potential that can be achieved by 2020. The height represents the average

cost of abating one tonne of CO

2

e (carbon dioxide equivalent) in 2020 by implementing that opportunity. Opportunities that fall below the horizontal

axis offer financial savings to businesses and households - even after factoring in the costs associated with capturing that opportunity