[

] 37

O

VER THE PAST

three decades, Grameen Bank has been able

to demonstrate that the provision of microcredit – small,

collateral-free loans to the poorest of the poor – is a

powerful intervention for the reduction of poverty. Grameen Bank

has provided USD5 billion to more than five million borrowers, 96

per cent of whom are women. Currently, Grameen Bank lends out

half a billion US dollars a year in loans averaging USD120. Its

repayment rate is 99 per cent. The bank is financially self-reliant,

and does not take any loans or grants from any source. All its funds

come from the deposits it collects from borrowers and non-borrow-

ers, and it routinely makes a profit. Grameen Bank’s experience has

shown that poor people, who have been systematically excluded

in the past by conventional banks, are creditworthy, and in most

cases, more creditworthy than the rich.

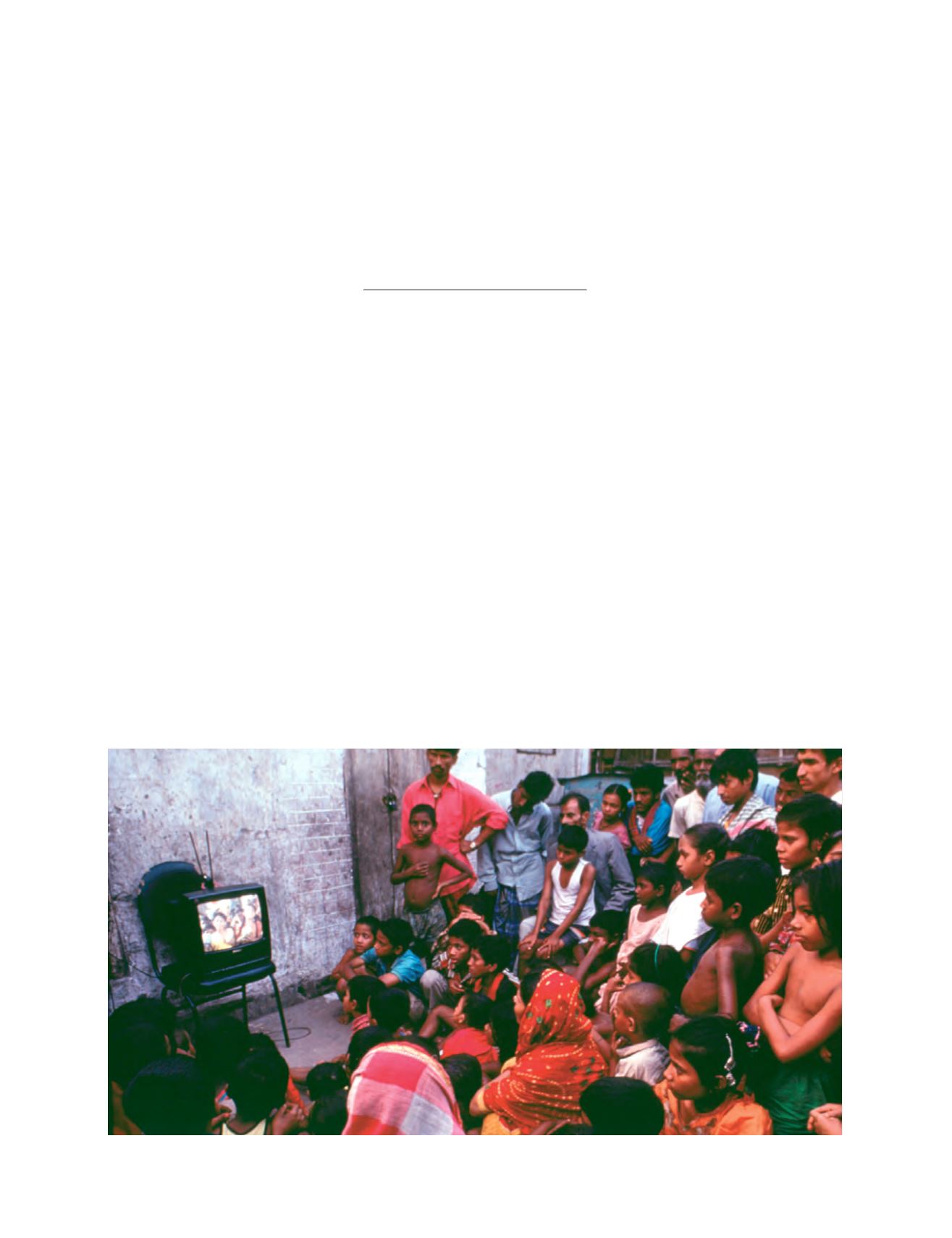

ICT and globalization

Information and communications technology (ICT) is changing

the way people do business globally. It has created a world where

communication is instantaneous and cheap. At the same time, ICT

is strengthening the processes of globalization. ICT and globaliza-

tion offer great social and economic opportunities for the devel-

oping countries, by enlarging market place and creating greater

access. But these opportunities will not be realized if left to market

forces alone. In order for the poor to ride the waves of globalization,

there has to be a sustained effort to equip developing countries,

and particularly the poor within those countries, with ICT.

Microcredit, ICT and the poor

There are some who believe that ICT is irrelevant for the poor. It

is thought to be too expensive, and too complicated for the poor

to use. The poor need food before anything else – they say. But

technology works in all directions. If ICT can be used by the poor

to generate income, why not go for ICT for the poor? Look at

health. We can use ICT to bring health to poor people. Whether

you want to deliver microcredit, or education, or health, ICT has

a powerful role to play.

Microcredit and ICT have a great synergy. Whether or not a

poor person can afford ICT does not depend on how much he or

she already has, it depends on whether financial institutions are

available to finance the project. Microcredit can provide such an

Bridging the digital divide:

the experience of Grameen Bank

in Bangladesh

Muhammad Yunus, Grameen Bank, Bangladesh

Photo: Sanjay Acharya/MAP