[

] 142

Institutional investment

in sustainable forestry

David Brand and MaryKate Hanlon, New Forests Pty Ltd, Australia

I

nvestors acquire forests or ‘timberland’ to generate long-

term returns from both the sale of harvested timber as

income and the capital appreciation from biological growth

of the tree crop.

1

Forestry investment by institutional inves-

tors has grown steadily since the 1980s, and it is estimated

that approximately US$48-60 billion has now been invested by

pension funds, insurance companies, foundations, endowments,

and sovereign wealth funds.

2

This growth in forestry invest-

ment has come about because the annual returns tend to show

low volatility, have limited correlation with other asset classes,

and have a positive correlation with inflation, and also due to

the fact that long-term investment in relatively illiquid assets

such as forests provides a good match for the long-term nature

of most institutional investor liabilities. Therefore forestry or

timberland can provide both portfolio diversification benefits

and a hedge against inflation.

Institutional investment in forests largely originated in

the United States, where the bulk of invested capital

remains today; however, in recent years the forestry

asset class has expanded internationally. An increas-

ing amount of institutional capital is directed to Latin

America, Australia, New Zealand, and now also Eastern

Europe, Asia, and Africa. As the level of investor interest

has grown, specialist fund managers have emerged to

offer regionally focused investments and also thematic

funds focused on particular species or niche investment

strategies. Such focused and thematic investment strate-

gies offer the potential to harness institutional capital

to support the expansion of sustainable forestry in key

new markets. New Forests

3

expects institutional inves-

tors will play an important role in defining the future of

the forestry sector, including bringing an emphasis on

sustainability, placing capital in new regions with new

market opportunities, and bringing new technology and

management know-how to emerging markets.

Investor demand for sustainable forestry

Through its interactions with institutional investors,

New Forests has seen an increasing emphasis on the

ways that managers integrate environmental and social

sustainability into their investment strategies. Generally

speaking, institutional investors are paying increased

attention to environmental, social and governance

(ESG) factors throughout their investment portfolios,

including in research and analysis, manager selection

due diligence, reporting requirements, and operational

management guidelines or standards. Some of these

investors may be concerned that potential investments in

real assets, such as timber, agriculture, natural resources

extraction, energy, and infrastructure, may have nega-

tive social and environmental impacts. These negative

effects may create significant risks for project cash flows

as well as wider reputational risk for the investors. In

order to help manage these risks, some investors require

their managers to become signatories to the United

Nations Principles for Responsible Investment (UN

PRI),

4

develop comprehensive ESG policies and ensure

their investments adhere to strict performance standards

such as those developed by the IFC, Forest Stewardship

Council or PEFC. Some investors are taking a long-term

view and actively looking to invest in assets that may

hedge against the potential impacts of climate change or

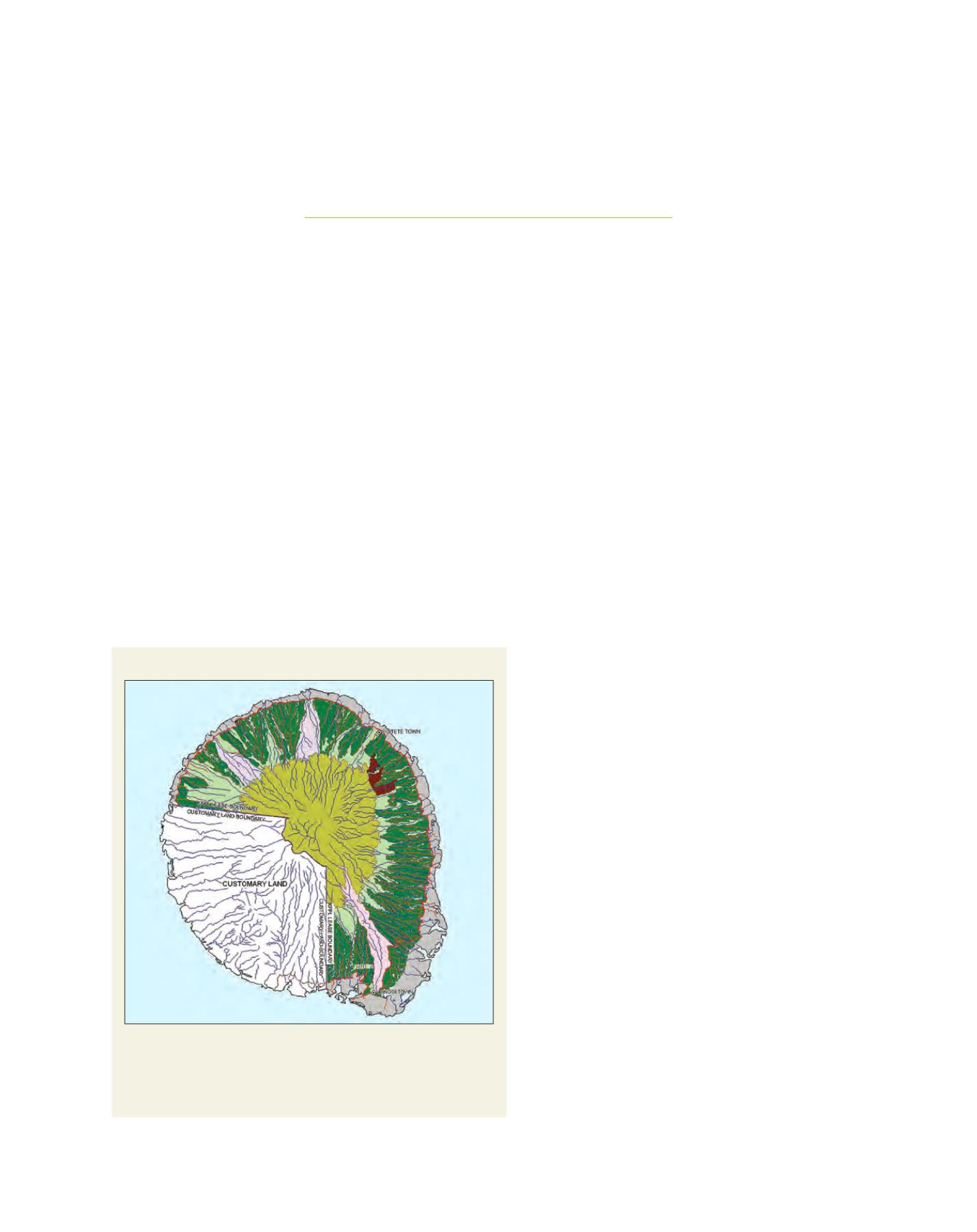

The island of Kolombangara

The island of Kolombangara in the Solomon Islands demonstrates a

mixed-use land-use system that combines production, conservation, and

community land use zones in geographically distinct areas. Kolombangara

Forest Products Limited (KFPL) holds a lease over approximately three-

quarters of the island

Source: KFPL