[

] 143

• The role of forestry and land use in mitigating and

adapting to climate change, particularly for forests

to sequester and store carbon in trees and soil, and

for biomass energy systems

• Meeting growing global wood demand without

compromising the future supply of natural resources

• Ensuring the provisioning of ecosystem services,

including habitat for important wildlife species and

functioning hydrological systems

• Increasing rural employment opportunities and

supporting related local livelihoods.

Socio-environmental co-benefits of forestry

investment

Environment and biodiversity

It is estimated that more than two thirds of the remain-

ing tropical forests are either already subject to logging

or are likely to be in the future,

6

and less than 10 per

cent of tropical forests are in strictly protected areas.

Numerous studies have shown that most plant and

animal species survive selective logging as compared

with conventional logging practices in the tropics.

7

However, biodiversity and other attributes of forests

are threatened by conversion to non-forest land uses.

Responsible forest management can provide local

employment, revenue flows, and raw materials for

processing industries. In addition, forest management

can increase the value of standing forests, which confer

additional socio-environmental benefits and stabi-

lize land use pressures on native forests. Nevertheless

timber harvesting in natural forests is controversial

the increasing expectation of a price on greenhouse gas emissions. For

example, a recent report published by the Mercer consulting group on

climate change indicates that in some cases the best way to manage

portfolio risk from climate change is to increase exposure to assets

that are less susceptible to the effects of climate change and that are

capable of adapting to low carbon development, such as forestry.

5

For investors with such sustainability objectives, New Forests

believes investment into certified, sustainable forest plantations can

be an important addition to a portfolio seeking to strengthen ESG

performance. Forest certification involves independent third-party

verification of environmentally and socially responsible forestry

practices and log tracking systems. Ultimately, forest certification

can improve forest management and add value to existing assets by:

• Boosting cash flows, e.g. by securing a certification price

premium on wood destined for environmentally sensitive end

markets or by increasing operating efficiencies and reducing unit

costs of production

• Reducing the riskiness of cash flows, e.g. by improving

relationships with local communities and other stakeholders

thereby reducing external disruptions to operations

• Increasing asset liquidity and value, e.g. by making forest

management more transparent, asset managers can reduce

information asymmetries between buyer and seller and enable

buyers to use a lower discount rate for asset valuation, and

strong environmental and social performance will attract a wider

pool of potential buyers.

Forestry investment offers substantial opportunity to integrate ESG

concerns throughout the investment process, and not just in the

physical operations. Some of the key sustainability factors that may

attract institutional investors include:

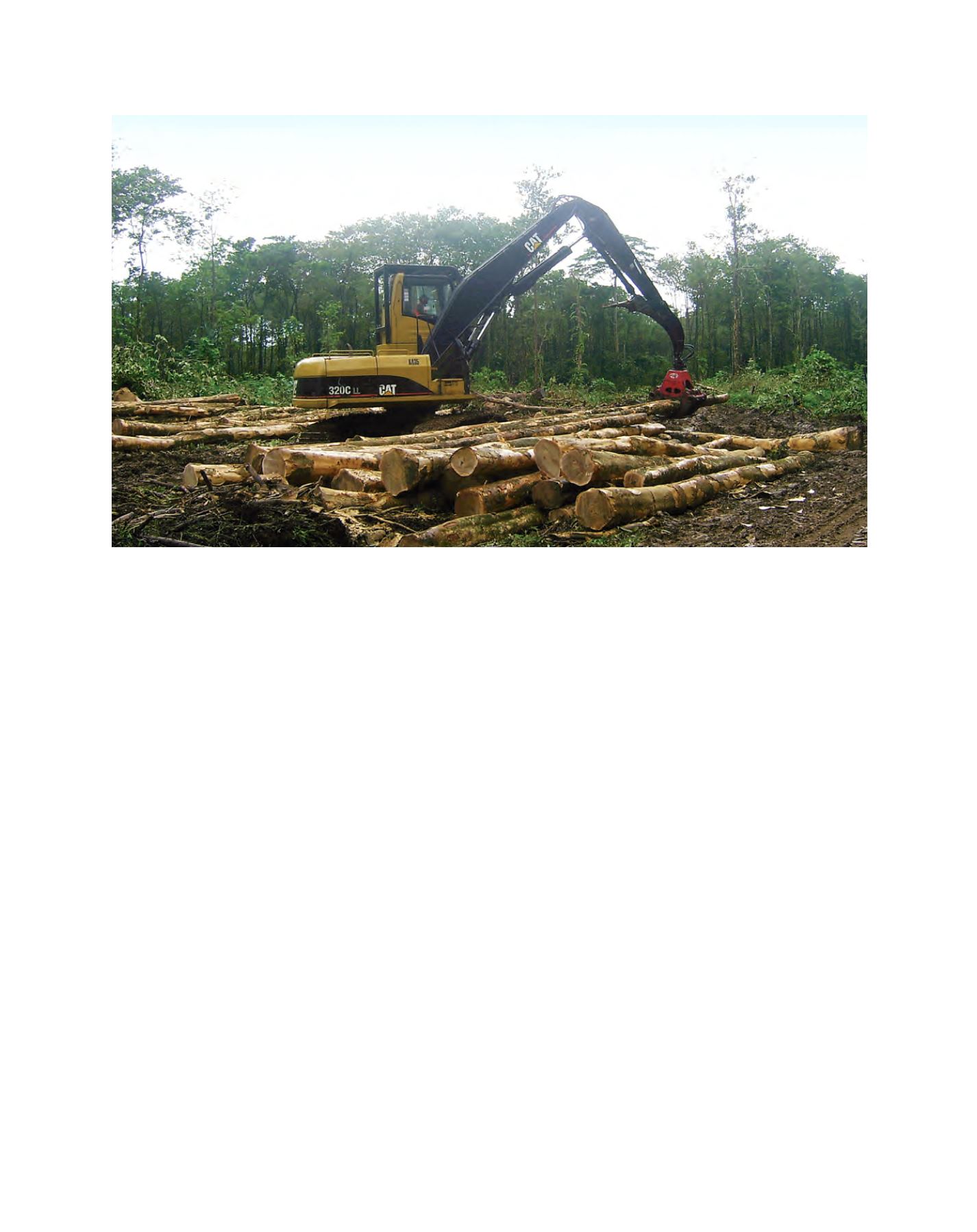

An excavator bunches logs and prepares them for loading onto a truck at Kolombangara Forest Products Limited

Image: KFPL