[

] 144

and most investors prefer to invest in plantations established on

marginal agricultural or degraded land.

Investing in forestry may include acquisition of existing plan-

tations or new unplanted (greenfield) plantation licence areas.

In some cases, particularly in Southeast Asia, this may involve

assuming management responsibility for heavily degraded

natural forest with residual biodiversity values. In order to main-

tain, restores, and enhance environmentally sensitive areas, such

as residual natural forest, natural forest cover on steep slopes,

riparian zones, and other high conservation value areas, forest

management plans can be created that intensify production in

the most suitable areas while allowing for conservation-based

management in others. Depending on local circumstances, in

some of the most degraded areas (e.g. non-forest or immature

secondary forests regenerating following agricultural use) inves-

tors may establish fast-growing, high-value hardwood plantations.

By applying this integrated approach that preserves environmen-

tal values and increases productivity, forest management plans

can result in natural forest/plantation mosaic landscapes produc-

ing timber and sustaining high levels of biodiversity over the

long term. Emerging environmental markets for carbon, includ-

ing programmes for Reducing Emissions from Deforestation and

Degradation (REDD) and biodiversity can be used to support

the investment model of intensive timber production combined

with protection of residual natural forest areas. Income from

environmental credits can be used to offset the costs of natural

forest set asides and make the combined production and conser-

vation model commercially attractive to investors. New Forests

believes this environmentally sensitive intensification is essential

for meeting global wood demand while alleviating pressure on

remaining natural forests.

Society and Stakeholders

While institutional investment seeks primarily to

generate returns that meet medium- to long-term

financial liabilities, forestry investment presents

economic opportunities that also reach local stake-

holders, including communities and governments.

This is particularly true in emerging markets, where

natural resource industries play a significant role

in development. Forestry investment in these areas

offers a sustainable development pathway that brings

revenue and livelihoods.

In remote areas and developing countries, rural commu-

nity development is often tightly linked with the health

and use of forest ecosystems. ESG integration can be

useful in ensuring local rights are respected and rein-

forced. Investors can utilize specialized consultants and

established processes such as free, prior and informed

consent and high conservation value area assessments

8

to

help assess and address these local stakeholder needs. For

example, areas that have high cultural significance can be

preserved for the long termwhen incorporated into a land-

scape system that diverts timber production and plantation

development to degraded or less sensitive areas. However,

in some cases local community needs may be incompat-

ible with some types of intensive forestry, and investors

following strong ESG and sustainability guidelines will be

capable of identifying appropriate areas for investment.

Institutional investment also brings funding directly

into local economies and can support livelihoods and

local stakeholders. Employment is created through onsite

operational activities, and regional or local specialist forest

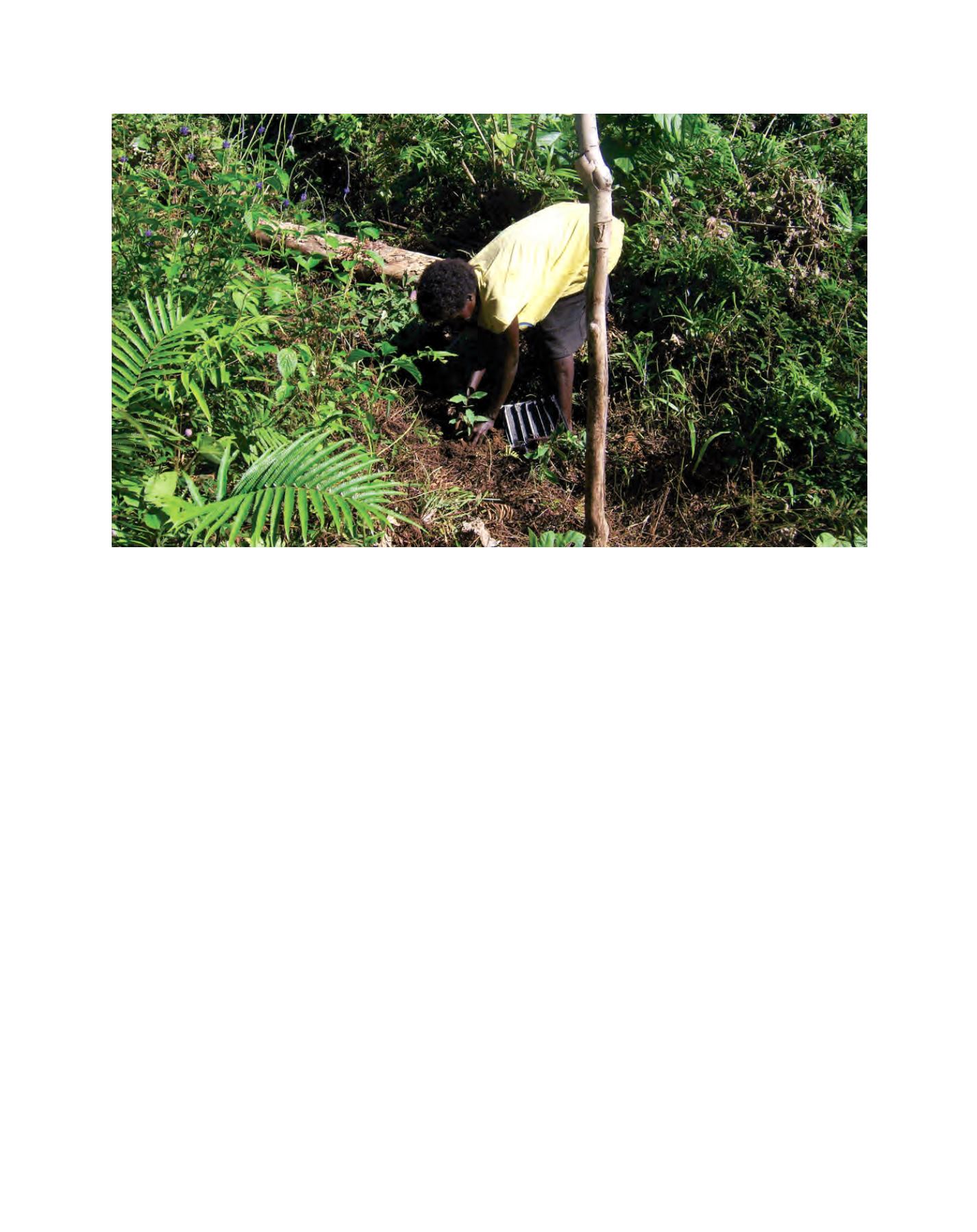

A woman contractor plants a seedling at Kolombangara Forest Products Limited in the Solomon Islands

Image: KFPL