[

] 145

managers contribute valuable expertise. FSC and other forestry certi-

fication schemes ensure that relevant labour guidelines and laws are

enforced to promote worker health and safety. These measures also

help ensure that employment is legal and non-exploitative. Additional

livelihoods are sustained through indirect economic impacts, such as

secondary processing and export-oriented activities. While the above

benefits are important for supporting stakeholders and promoting live-

lihoods, forestry investors must be aware of potential negative impacts.

It is possible that increasing incomes in rural areas can lead to social

conflicts due to changes in community power structures, local inflation,

and increased migration pressures.

The future of timberland investment

The case of KFPL is an early example of the potential for institu-

tional capital to generate attractive and stable investment returns

while at the same time creating and sustaining positive social and

environmental outcomes within the forestry sector as an emerging

market. As the responsible investment movement matures, more

and more investors are looking beyond merely avoiding negative

social and environmental impacts associated with their investments;

these investors are now actively seeking opportunities to catalyse

sustainable outcomes. With direct connection to ecosystems,

consumer goods and rural livelihoods, the forestry industry offers

ample potential for such sustainability-oriented investing. At the

same time, the socio-environmental management of forest areas and

plantations can directly improve the bottom line via risk mitigation,

increased efficiency and long-term asset appreciation. As institu-

tional investment in timberland expands its reach beyond the North

American market, these opportunities for aligning commercial and

socio-environmental returns are becoming more pronounced and

allowing for transformative investment strategies in the forest sector.

Kolombangara Forests Products Limited

The case of Kolombangara Forest Products Limited (KFPL)

in the Solomon Islands demonstrates how private capital

and a sustainable investment approach can yield substantial

benefits. KFPL was established in 1989 by the Government

of the Solomon Islands, represented by the Investment

Corporation of the Solomon Islands (ICSI) and the United

Kingdom’s development finance institution, then known

as the Commonwealth Development Corporation or (CDC).

While the Solomon Islands have experienced widespread

harvesting of their native tropical forests, KFPL was created

as an example of integrated conservation and development.

The 39,000-hectare KFPL estate comprises 12,000 hectares

of hardwood plantations, including gmelina

eucalyptus

, teak,

mahogany and other species, and over 25,000 hectares

of natural rainforest under conservation and natural forest

management. KFPL’s operations achieved FSC certification

in 1998, the first in the Pacific Islands.

In 2006, a majority shareholder position in KFPL was

acquired by New Forests on behalf of an American

investment fund, and CDC (at that stage renamed

CDC Group Plc) exited the investment. The new deal

was supported by a grant that enabled the Investment

Corporation of the Solomons Islands to maintain its share

in the company. At that time, KFPL employed more than

200 people with approximately 700 additional employment

positions for contractors. KFPL’s status as a producer of FSC

wood was a critical factor in the acquisition, as it provided

assurances on social and environmental management to the

institutional investors.

The 2006 investment provided additional capital resources

to help the plantation company meet its potential as a

producer of tropical plantation hardwoods. The investor

looked at long-term strategies and was able to cover short-

term debt, enabling KFPL to invest in new equipment and

resources to improve its production and become more

efficient. The new investor was also able to bring the latest

forest management expertise drawing from worldwide

experience to modernize the systems at KFPL. This included

improved description of the resource, updating the forest

information, account systems, and databases to enable

accurate analysis and reporting. These measures enabled

better strategic and operational decision-making that

ultimately improved the asset value and ensured that

KFPL remained a strong example of sustainable forestry

investment yielding multiple local benefits.

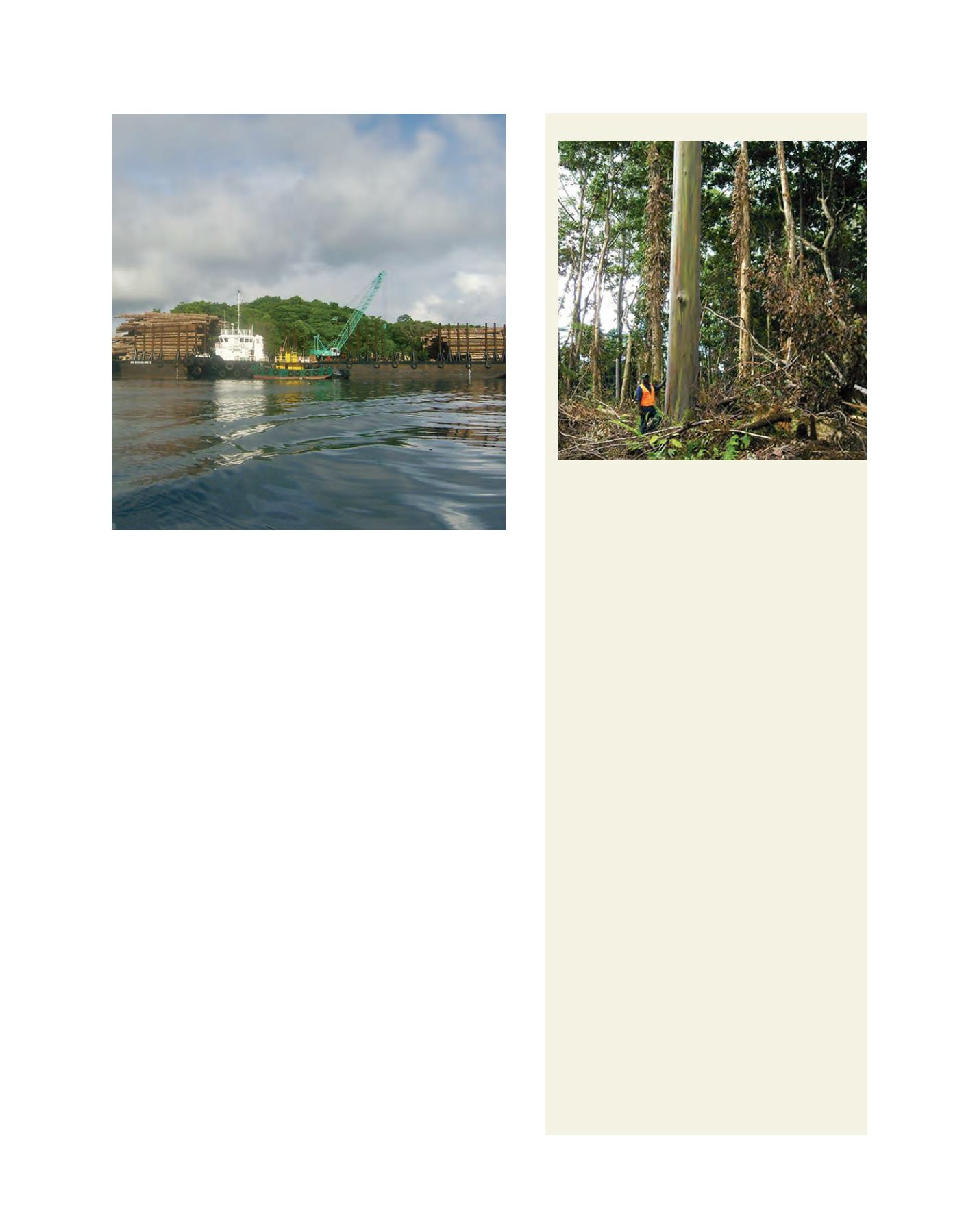

Logs are loaded for shipping from the Solomon Islands to Viet Nam, sold to a

furniture manufacturer seeking FSC-certified timber

Image: KFPL

A KFPL employee near a 20-year old plantation

eucalyptus

tree

about to be harvested near the edge of the buffer reserve

Image: KFPL