[

] 166

F

inancing

C

ooperation

disadvantaged families in these slums to connect to piped

water and shallow boreholes for safe, reliable drinking

water. Moreover, the WaterCredit programme catalyses

a necessary market adjustment that has the potential to

transform millions of lives as households gain access to

the capital they need to benefit from improved water and

sanitation services.

A unique opportunity

WaterCredit is one example of a microfinance-style

approach to the water and sanitation crisis, which

provides a unique opportunity to address community

residents’ immediate demands and drive large-scale

system change within the sector. By bringing in

other thought leaders and socially-driven businesses,

innovative financing models can address the flawed

system that has limited large-scale and lasting solu-

tions to the water and sanitation crisis. The next

stage of growth will focus on improving investor

confidence in providing finance mechanisms for the

poor – a vast customer base that is overlooked by

the finance industry.

The success of WaterCredit in places like Bangladesh

demonstrates that poverty is not absolute and that a signif-

icant segment of the poor are willing and able to pay for

services when affordable financing is available. As micro-

finance solutions for this crisis are scaled and expanded

in new regions, the level of philanthropic investment

required to incubate this programme will decline, allowing

subsidies to be strategically channelled to the ultra-poor

for whom credit-based solutions may not be viable. If

other organizations join in this solution, we can empower

millions of individuals in underserved communities

to participate in their economy as water and sanitation

customers, and take ownership of their future.

bills, which helps increase the repayment rate. DSK staff provides

critical hygiene education activities, including street plays and

school events, which raise awareness of contributing factors to

water- and sanitation-related diseases. As well as providing critical

health messages, the education activities and training raise aware-

ness about WaterCredit loan products and generate demand for the

loans. DSK found that general ‘community assembly’ programmes

provided a unique way to bring residents together – for example to

watch documentary films on sanitation or organize street plays on

hygiene – creating general ‘camp-like’ atmospheres for residents to

learn about WASH awareness. Once demand is high, loan officers

typically meet with interested borrowers to fill out an application

and create a repayment plan. The borrower’s family can then benefit

from a household or community-level water connection and/or

toilet, depending on their needs.

Through its WaterCredit programme with DSK,

Water.orgcontrib-

uted financial resources and provided monitoring information systems

training to staff. DWASA provided capacity building and training on

water and sanitation services, which enabled DSK to send community

development officers out to work with targeted slums.

Water.organd

DSK realized the programme created a winning situation for all parties:

the government utility wanted paying water customers and to fulfil its

mandate, while slum residents wanted to have local, legal access to

available services.

Water.organd DSK continue to carry out this programme to extend

the reach of local utilities’ established water networks in these slum

communities, and demonstrate that those living at the BOP represent

a reliable customer base. As a result, more than 60,000 slum residents

no longer have to pay an exorbitant price for safe water from illegal

vendors and instead have financed their own household or commu-

nity-level solution. This work would not be possible without the

constant cooperation between a government utility, an eager, socially

driven NGO and smart philanthropy from donors such as Johnson

& Johnson. Through DWASA’s engagement in the process, Water.

org and DSK can continue to provide WaterCredit loans that enable

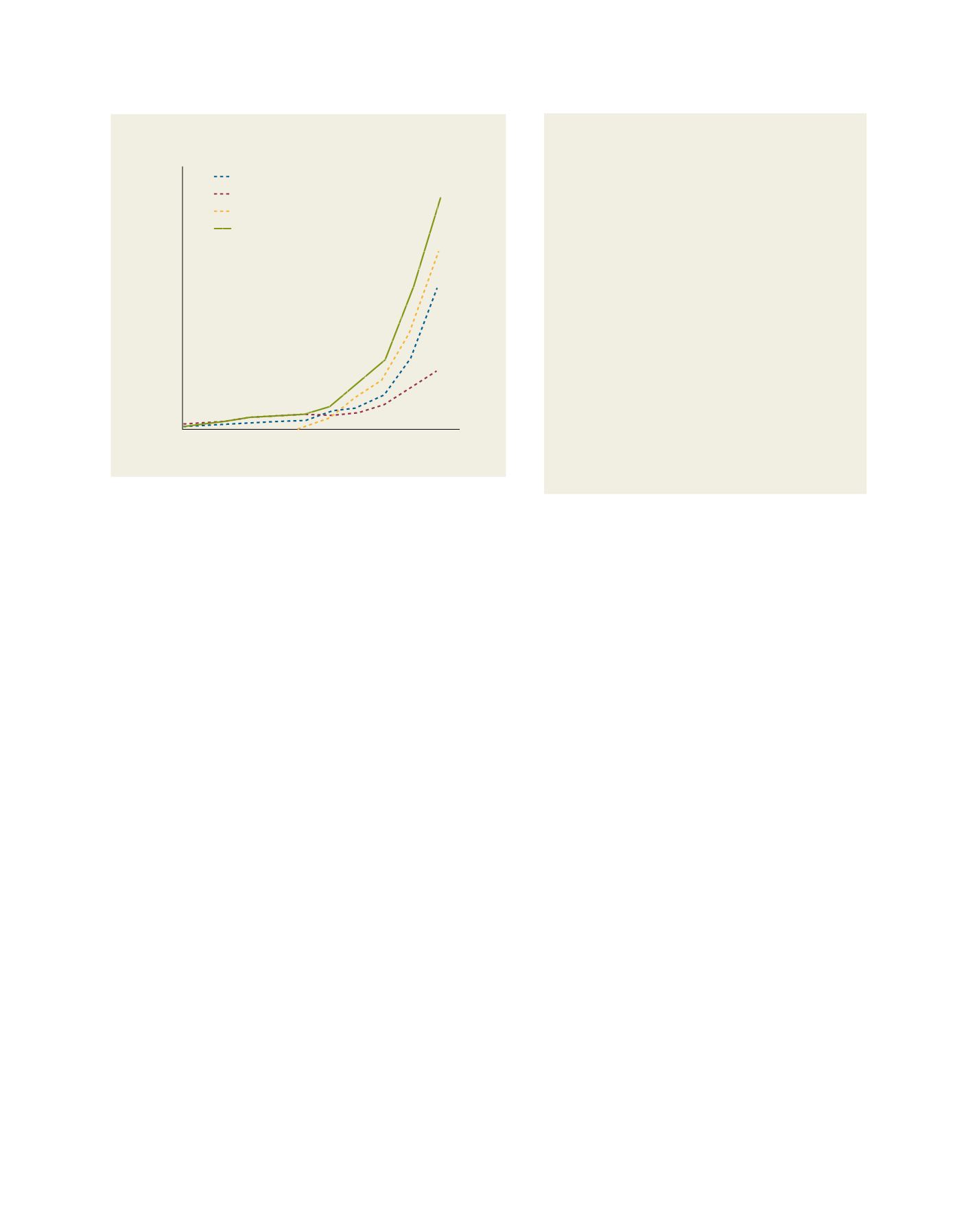

Value of loans disbursed

5

10

15

20

25

30

US$ (million)

Year

2004 2006 2008 2010 2012

Smart subsidies to MFIs

Commercial capital leveraged

Total capital invested in WaterCredit

WaterCredit investment since 2004, including smart subsidies,

commercial capital, and value of loans disbursed

Source:

Water.orgSuccess story: Banesa

Before experiencing the joy of a toilet, 48-year-old Banesa

Begum and her family of five had no choice but to defecate in

the open or share an unhygienic hanging latrine with neighbours.

Hanging latrines are shoddy structures often made out of

bamboo that sit a few feet above the ground. The human

waste is not contained or treated and often enters into the

water sources, causing disease.

Banesa and her family never had privacy. They endured

horrible smells and suffered with dysentery, diarrhoea and

worms. While Banesa’s family desired a toilet, it was not a

possibility because they were trapped in the cycle of poverty,

barely making ends meet.

Water.organd DSK visited the Fulbaria slum in Dhaka,

Bangladesh, where Banesa lives. They met with the

community and held awareness programmes about the

dangers of hanging latrines and open defecation. And best of

all, they offered an affordable solution through WaterCredit.

Banesa and other community members decided to take out a

WaterCredit loan and install a hygienic toilet. They borrowed BDT

60,000 (US$799) and built a community latrine. Today, all of the

family members have privacy. There is no longer a pungent smell

and the children are able to use a toilet safely. All are happy to

finally have a toilet, and no longer struggle with disease. Health

has come to Banesa, her family and her community.