[

] 200

invoicing project that is expected to deliver substantial savings

and help support the company’s compliance and corporate

governance policies.

It is difficult to estimate the potential savings of electronic

invoicing. In any case, it is a very significant figure. The EU talks

about EUR50 billion per year for the region,

5

while the Italian

CNEL working group has pointed out to a EUR30 billion figure

for Italy alone.

6

Every year somewhere between 10 and 20 billion invoices are

exchanged between companies in the US and EU countries alone.

The total processing cost of an invoice (which includes both the

expenses of the seller and those on the buyer side) is somewhere

between EUR20 and EUR30. The estimated saving that can be

achieved through automatic processing is generally estimated to

be 70-80 per cent of that figure.

7

(Figure 1).

With a few notable exceptions such as Finland, the actual adop-

tion of electronic invoicing in the market has been most

disappointing: in Europe at least 95 per cent of invoices

exchanged between companies are in still in paper form.

8

An explanation of the surprisingly low diffusion in most coun-

tries can be found in the so-called network effects. The advantages

of electronic invoicing are contingent on reaching a critical mass

of users as illustrated by the spread of the fax machine.

In 1984 about 80 000 fax machines were sold in the USA. In

1987, when the number of fax machines hit 500 000 units (the

tipping point), sales of fax machines exploded, reaching one

million per year. The fax machine had suddenly become indis-

pensable.

9

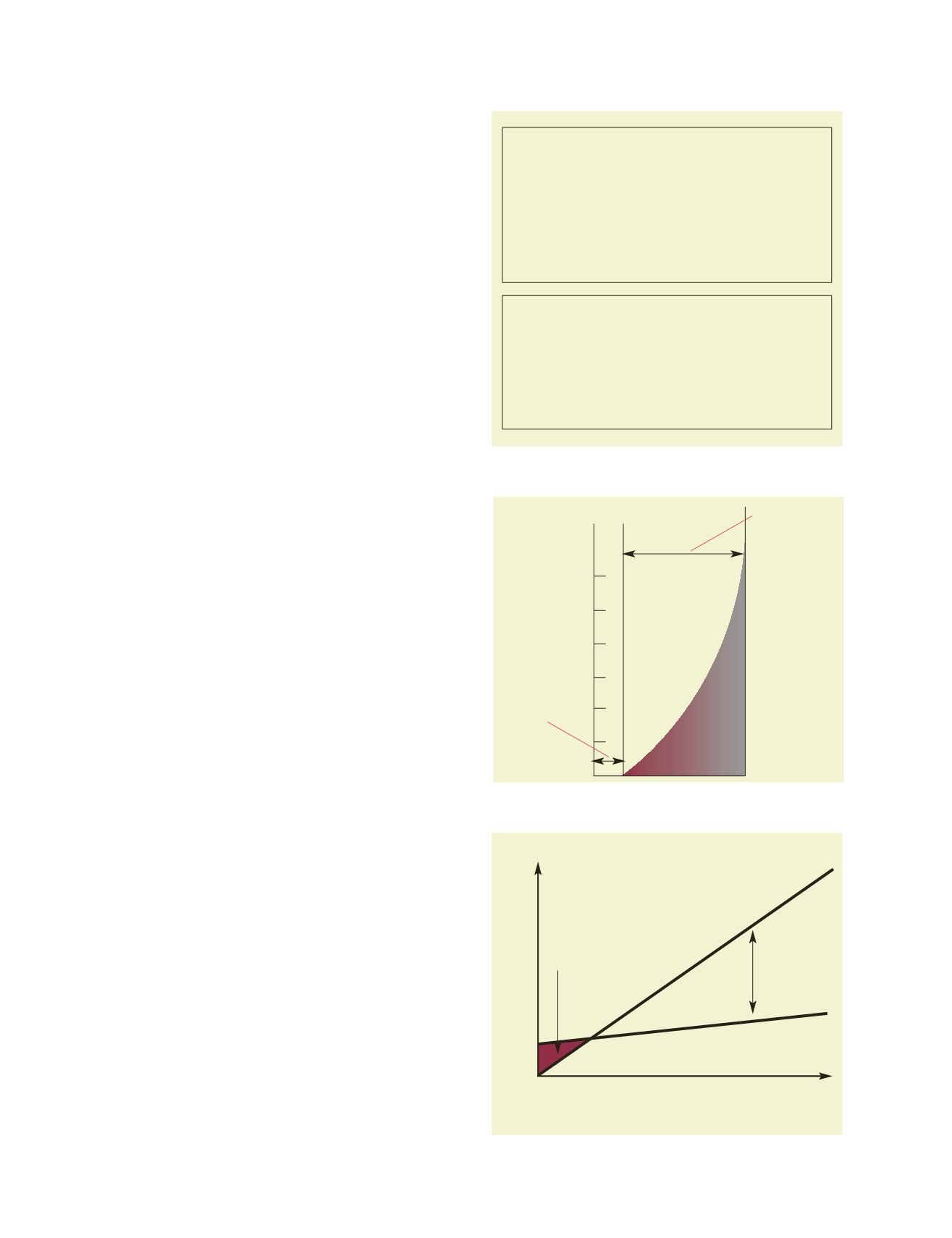

However, below the level of critical mass a service that obeys

‘network effects’ delivers a value that, by definition, is less than

its cost (Figure 2).

A seller has little or no interest in migrating to electronic invoic-

ing until his business partners do the same, especially considering

that the savings of electronic invoicing are greater for the buyer

(who can automate a complex and costly process) than for the

seller (who saves post and archiving costs) (Figure 3). In this

phase the few early adopters are easily discouraged.

For instance, in a number of EU states the migration to elec-

tronic invoicing is made difficult by the complexity of the legal

requirements. The irony of the situation is all too obvious, if one

just thinks that electronic invoicing gives tax administrations a

new weapon with which to fight against tax evasion.

The regulatory obligations required by some EU member states

(electronic signature, time stamp, electronic invoice archiving

rules etc.) can be satisfied by using third party software solutions,

which encapsulate the regulatory requirement. The problem is

that these solutions are ‘black boxes’ for the seller, who is still

responsible for the correctness of the invoice towards the tax

administration. The answer is a proactive role for tax adminis-

trations in supporting suppliers of electronic invoicing solutions,

to give users certainty of the regulatory compliance of the e-invoic-

ing solutions offered by the market.

Supporting electronic invoicing is also important to assure that

electronic invoicing will be equally adopted in developing coun-

tries and will not end up making only companies from developed

countries more efficient, thus increasing the digital divide. If the

network theory is correct, this represents a very concrete risk.

Electronic invoicing is not going to happen without active promo-

tion and support, which is weak or downright absent in developing

countries. Furthermore, the regulations covering electronic invoic-

ing in developing countries are often complex or unclear, which

puts a further burden on the shoulders of early adopters.

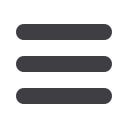

SELLER

» Lower invoicing costs, no paper,

no printing, no stamps

= 1-4

€

/invoice

» Improved cash flow

= open

» Improved customer relations

= open

BUYER

» Lower costs for invoice receipt

checking and reconciliation = 9-30

€

/invoice

» Improved cash management

= open

» Better quality of data

= open

Figure 1: Advantages of electronic invoicing

Under the

“critical mass”

the value of the

service for the

user is lesser

than its cost

Utility=Users

2

Over the

“

critical mass

”

the value of the

service for the

user is greater

than its cost

Figure 2: Metcalf’s law

Utility value

of service

Euros

Costs

Savings

Benefits

Net loss

Number of electronic invoices/month

Figure 3: Savings of electronic invoicing for the seller