Unprecedented access

With more than 660 000 postal outlets combining the physical,

electronic and financial dimensions of a worldwide communi-

cation network, postal services provide a natural gateway to the

Information Society. The distribution of information and goods,

the provision of financial services and access to information via

Internet points inside post offices also contribute to the

economic and social development of countries.

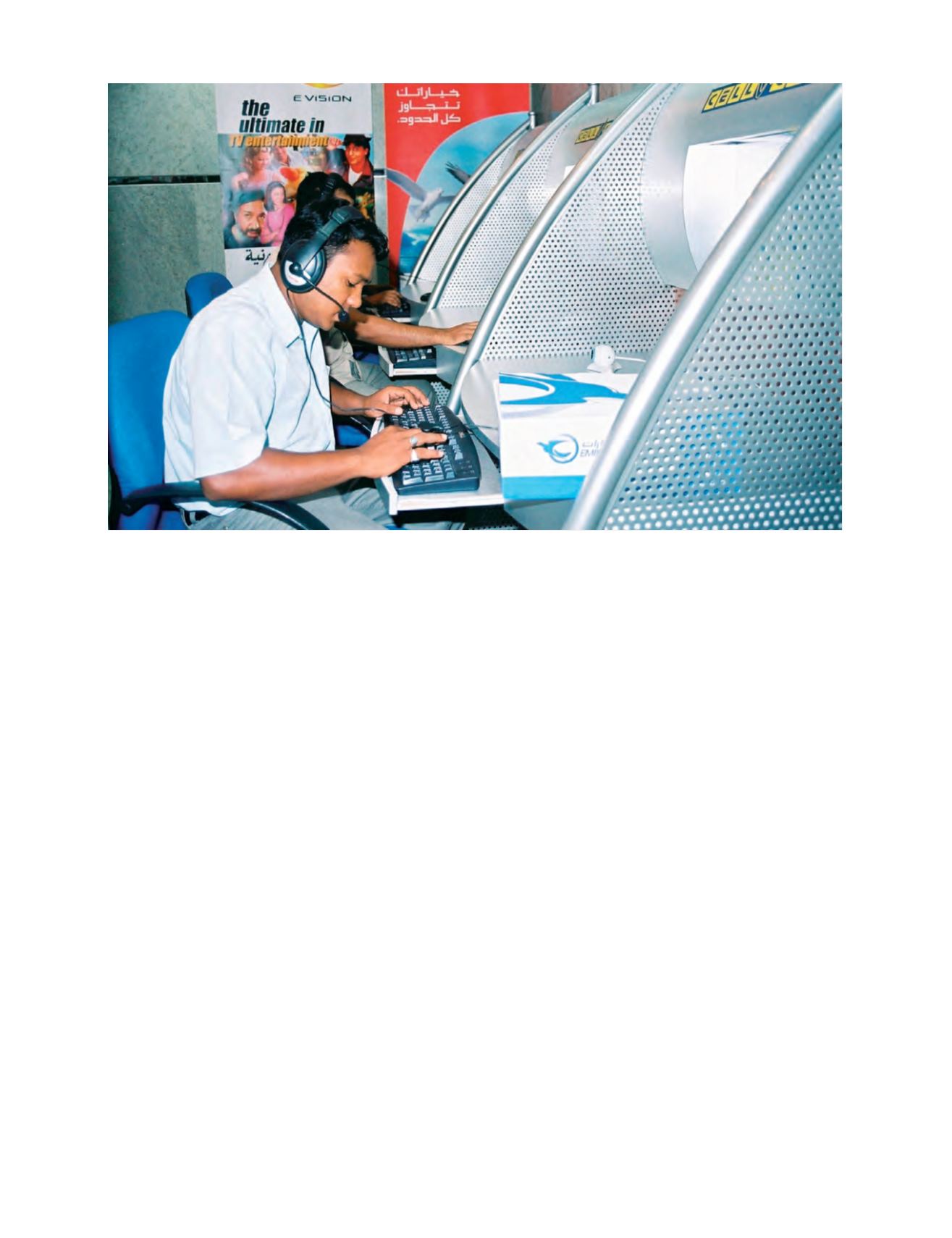

Post offices were widely recognized as ideal access points in the

Geneva Action Plan adopted during Phase One of the WSIS,

precisely because of their accessibility. Internet kiosks inside

postal outlets have mushroomed in recent times, providing

access to information about social services such as health care

and education, as well as access to markets where products can

be purchased and sold. In this way, it directly and indirectly

supports the United Nations Millennium Development Goals

helping to reduce poverty, increase literacy and gender equality,

and improve health and environmental sustainability.

Connectivity through secure money transfers

UPU believes that the financial component of the world postal

network is an integral part of the global effort to develop

economies and reduce poverty. Postal financial services – in

particular postal savings and third-party agency services offered

by Posts on behalf of private and public enterprises – provide

isolated communities with access to vital services and thereby

contribute greatly to their economic and social development.

Posts worldwide perform some ten billion financial transactions

a year, of which more than 15 billion involve money orders,

amounting to more than USD130 billion per year. It is in this

area that UPU believes the postal network can make a difference,

especially at a time when the World Bank and G8 countries are

addressing issues around international migration.

The United Nations estimates that migrant workers represent

three per cent of the world population, and figures show that

the number of money transfers by these workers continues to

grow each year. According to a World Bank report, money trans-

fers by migrant workers reached USD110 billion in 2004, an

increase of 52 per cent from 2001. This transfer of funds repre-

sented five per cent of developing country imports and eight per

cent of domestic investment, making it the second largest source

of investment in these countries after direct foreign investment.

Certain drawbacks remain however, most notably the costs

associated with money transfers. UPU is convinced that the

worldwide postal network offers a solution and will therefore

continue to expand the network with its International Financial

System (IFS); a suite of applications that facilitates the elec-

tronic fund transfers between public postal operators and with

certain banks. It is a secure service that reduces the risk of

money laundering. The system is already implemented in more

than 30 countries and is expected to connect up to 70 coun-

tries by the end of 2007. A recent recommendation approved by

the Council of Arab Ministers for Telecommunications and

Technology could see the majority of Arab countries linked to

the IFS by 2006. UPU also works with other solution providers

in a constant effort to expand its network and recently set up a

gateway with the Eurogiro network to facilitate the transmis-

sion of electronic money orders.

As Director General Edouard Dayan points out: “Easy access

to money transfers at affordable rates addresses a key need for

millions of people, especially migrant workers, and the postal

sector has the capacity to respond to this need with its vast

[

] 61

Internet kiosks and cyber cafés inside postal outlets (as seen here in the United Arab Emirates) provide access to information about social services as

well as markets, thereby contributing to achieving the Millenium Development Goals by helping to reduce poverty, increase literacy and gender

equality, and improve health and environmental sustainability

Photo: Universal Postal Union ©