[

] 96

O

VER THE PAST

decade there have been significant improve-

ments in access to basic information and communication

infrastructure (ICI), although the picture is more mixed

for advanced ICI. Progress to date has been due to new technolo-

gies, declining costs and considerable investment, with a growing

share of that investment coming from the private sector.

Competitive, well-regulated private investment remains the key to

meeting the growing demand for ICI.

Going forward, there are considerable investment needs for ICI

in developing countries, and the first question is how to attract

private financing to meet those needs. Even with greater private

involvement, however, gaps will remain. Some investment gaps can

be filled with pro-investment policy and regulation, and by lever-

aging the government’s role as consumer and infrastructure owner.

Some gaps may also require government-supported access initia-

tives. While the donor community plays a relatively small role in

overall financing, the role for donors and the World Bank Group

(WBG) in particular can still be significant.

A changing digital divide

The WSIS Plan of Action called for more than one half of the world’s

population to have access to information and communication tech-

nology (ICT) by 2015.

2

If that is defined at a basic level as living

in an area covered by a mobile network signal, that goal has already

been surpassed in every developing region, with an estimated 77

per cent of the world’s population covered by the mobile footprint.

3

In fact, at least in terms of access to basic infrastructure, the digital

divide is rapidly closing. People in the developing world are getting

more access to ICT and basic voice access goals are being met at

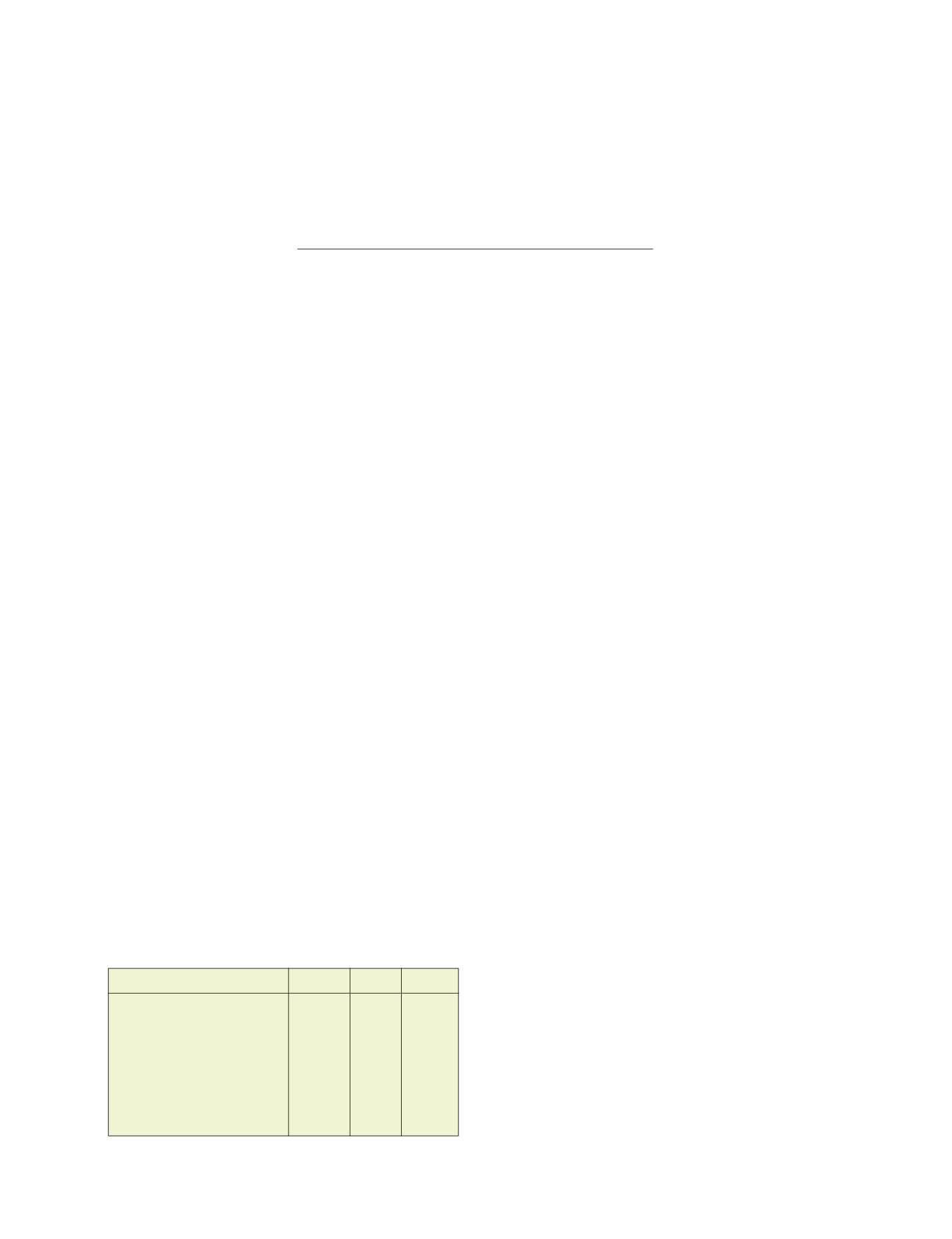

an incredible rate (Figure 1, based on IUT 2004a).

This positive trend is also clear from surveys asking organiza-

tions to list the major constraints they face in doing business. These

surveys are available from over 80 countries in the developing

world.

4

No doubt as a result of significant worldwide improve-

ments in access and quality of ICT, telecommunications limitations

rank far down in the concerns of most businesses worldwide –

last in a list of 14 constraints including factors such as policy uncer-

tainty, corruption, electricity, transportation, and access to land.

Regarding access to more advanced ICT such as the Internet,

however, the picture is more balanced. While the growth of

Internet users in the developing world has been faster than growth

rates in rich countries since the mid 1990s and, compared to

what might be expected given the size of their economies, the

developing world is doing quite well in terms of usage, still only

about one in 100 sub-Saharan Africans use the Internet, for

example. Interregional Internet bandwidth between Africa and

the US is less than one three-hundredth of the capacity between

the US and Europe. Sub-Saharan Africa has less than one-thirti-

eth of the broadband subscribers and less than one-eighth of the

international bandwidth than would be suggested even by its

small share of world GDP. This suggests significant work still

needs to be done to bridge the digital divide.

Growing share of private investment

Driving the worldwide trend towards infrastructure rollout is the

availability of new technology and falling prices, combined with

considerable investment spent with greater efficiency. Annual

telecommunications investment in the developing world has

doubled over the last ten years (rising from 21 per cent of the world

total in 1992 to 46 per cent by 2002). And although investment has

declined from its peak in 2000, the decline has been less dramatic

in the developing world than the rich world (Figure 2, calculated

from ITU, 2004a).

Looking further at these investments, we find that their source

has changed markedly over the past ten years – with an increas-

ing percentage coming from private operators. Between 1990 and

2000, over 350 private operators began providing mobile services

in more than 100 developing countries. In Africa, the top six

(private) strategic investors in mobile had total revenues in 2003

estimated at USD7 billion, with profits of USD800 million.

5

Moreover, since 1988, 76 developing countries have privatized

their fixed public telecommunication operators, raising over

USD70 billion (Guislain and Qiang, 2004).

Investments in infrastructure projects with private participa-

tion in developing countries totalled USD210 billion between

1992 and 2002.

6

Sixty-six developing countries have attracted

private participation in telecommunications infrastructure worth

in aggregate more than five per cent of their GDP between 1990

and 2002, including 14 in the sub-Saharan region.

Financing information infrastructure

in the developing world

1

Rym Keremane and Charles Kenny, World Bank

Figure 1: Teledensity (fixed and mobile) per region

1990

1996 2002

Africa – Sub-Saharan

1

1.4

5.3

East Asia & the Pacific

5.5

11.6

38.1

Europe & Central Asia

12.8

17.3

38.9

Latin America & Caribbean

6.4

11.5

36.7

Middle East & North Africa

4.7

8.3

22.4

South Asia

0.6

1.5

4.5

Developed Countries

46.5

64.1

120.1