[

] 97

influenced such decisions were ranked by investors in approxi-

mately the following order of concern (highest to lowest):

regulatory consistency, rate of return, quality of local partners,

direct control, country risk, repatriation of profits, currency risk,

the scale of the investment, and insurable risks (Ure, 2004).

Therefore, reform covering FDI, regulatory stability, and capacity

building would help to attract and retain financing.

Beyond providing the legal and practical opportunity to invest,

it is clear that risks and returns drive private financing decisions

in ICI as much as in other sectors. Here the evidence suggests

that, in the right policy and regulatory environments, ICI invest-

ments can make considerable returns in every region of the world.

Taking the example of the International Finance Corporation’s

(IFC) telecommunications portfolio, estimated returns are double

the Corporation’s average (World Bank, 2002).

Private involvement will not be enough to fill the gap

While the private sector can meet a great part of the developing

country’s demand for telecommunications services, it is likely that

the private sector alone, even if supported by strong regulatory

institutions that foster fair competition and a broader investment-

friendly climate, will not meet demand for all information and

communication infrastructure services that are economically effi-

cient or socially acceptable, especially when looking forward to

an evolution from narrowband to broadband networks.

For example, geography is still a key determinant of communi-

cations costs and functionality. Basic reform may also leave gaps

in national backbone networks (typically long-term investments

with significant sunk costs) or in cross-border facilities (transac-

tions costs and timing uncertainties of multi-jurisdictional

investments provide a daunting extra challenge to investors).

Finally, countries where security uncertainty is so high that

investors are deterred from even very profitable ventures may also

face considerable difficulties in attracting sufficient private invest-

ment to meet immediate needs for ICI in support of reconstruction

efforts. Therefore, there is a major role to play from the public

side, taking advantage of policy and regulatory levers, but also by

direct government subsidy of rollout initiatives.

Competitive, well-regulated private

investment remains the key

While much progress has been made in closing telecommunica-

tions supply gaps in developing countries, there is still a long way

to go, both to fill existing supply gaps and also to meet the

growing global demand for telecommunications services. Looking

forward, governments can play a key role in achieving this by

attracting private investment.

The evidence is overwhelming that countries which have intro-

duced private, competitive provision of telecommunications

services under a strong regulatory framework have seen far more

rapid rollout of information and communication infrastructure.

One recent study suggested that low-income countries which

had seen considerable reform towards competition saw a growth

of 1 075 per cent in Internet users over the 1998 to 2000 period,

compared to 405 per cent growth in countries that were lagging

on the basic reform agenda. The same study suggested that fixed

and mobile teledensity was approximately 80 per cent higher in

reformed low-income countries than in non-reformed countries

(Kenny et. al., 2003). The first step for many countries to attract

greater private competitive financing is therefore to complete the

basic reform agenda of opening up to private competitive oper-

ators. Nearly half of the world’s governments still maintain a

monopoly in the international segment, for example (Figure 3,

source: ITU 2004b).

In addition, particularly important in a sector such as telecom-

munications is the ability to attract foreign direct investment

(FDI). In fact, FDI has been the major source of private partici-

pation on telecommunications infrastructure projects to date.

FDI restrictions not only place a maximum limit on potential

foreign private investments (many countries limit foreign partic-

ipation in ICI to less than 50 per cent), they can also deter such

investments altogether. A recent survey of strategic telecommu-

nications investors in Asia asked about the determinants that

encourage or deter private investors, and found that investment

decisions in the sector depend on far more than sector-specific

policies and regulation – not least of which is the broader macro

and institutional environment. Nine specified risk factors that

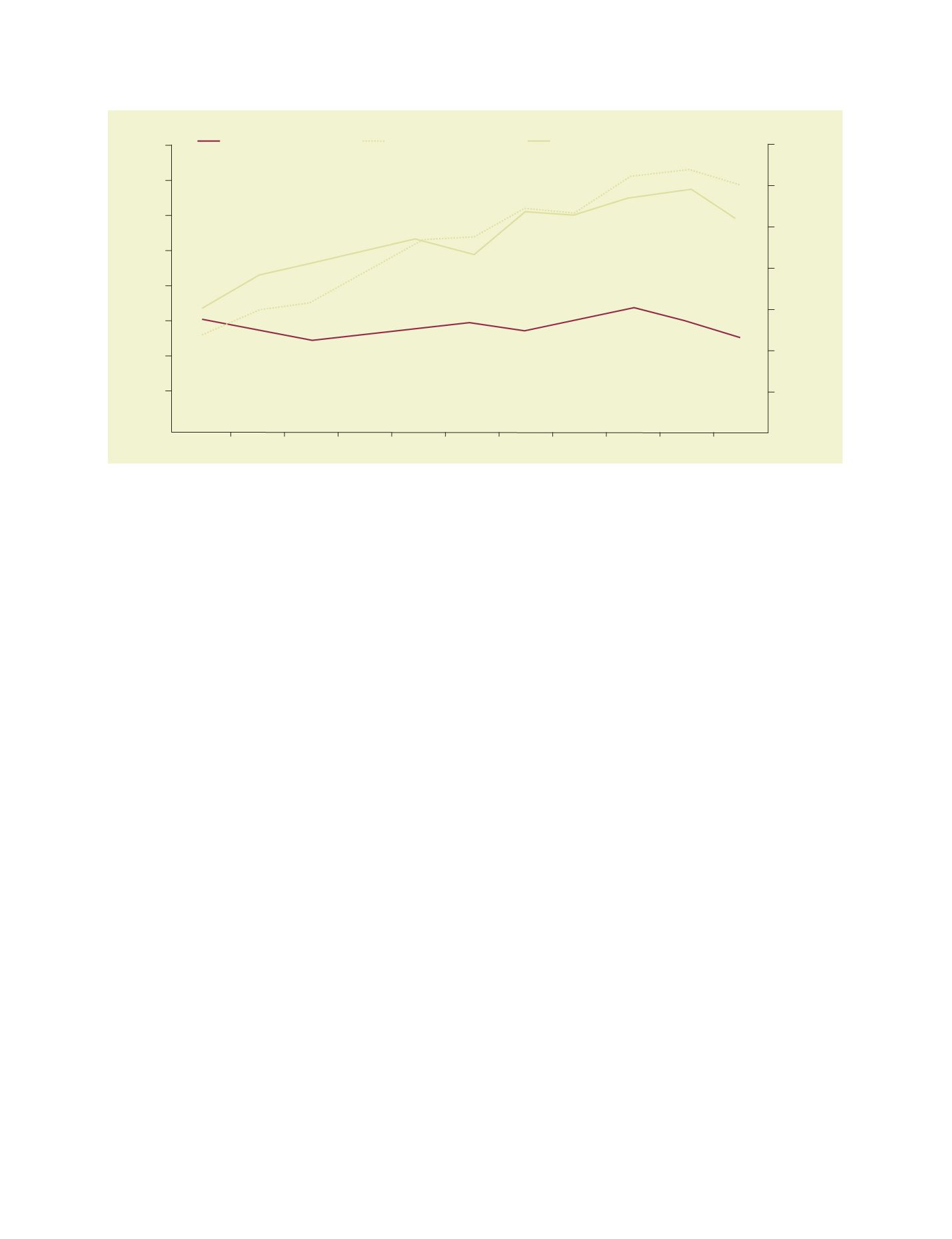

1992

Wealthy % GDP

0.2

0

0.4

0.6

0.8

1

1.2

1.4

10

0

20

30

40

50

60

70

80

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

Developing US$ Billion

Developing % GDP

$ Billion

% GDP

Figure 2: Telecommunications investments in the developing and developed world