[

] 98

Some gaps can be filled by leveraging the government’s role

as consumer and infrastructure owner. By offering to pay for

services to be rolled out to public sector operations in rural

areas such as schools, hospitals, and customs posts, govern-

ments can provide an incentive to private operators to serve

local communities. For example, in Mongolia a World Bank-

backed project supported the Ministry of Finance to link up

rural banks using a private provider of services who also plans

to offer telecommunications services to people living near the

connected banks.

In addition, because governments remain in the business of

providing a number of other networked services, there is also the

opportunity to leverage those networks to reduce the economic

cost of backbone build-out. The potential to roll out ICI along-

side other networks such as power, rail, water, pipelines, and

roads is a significant one. In many cases, utility operators have

already built private telecommunications networks along these

rights of way with capacity that can be leased to private telecom-

munications companies.

Some gaps may require government-supported access initia-

tives, such as Universal Access funds. In the wealthier developing

countries where most funds to date have been created, the most

frequently used mechanism has been to collect between one and

two per cent of the annual revenues of telecommunications oper-

ators. In poorer countries, funding universal access from a revenue

or spectrum levy alone is unlikely to be practicable in the short

run, and the use of government budgetary resources may become

necessary, perhaps financed by donors. A very approximate upper-

end estimate suggests that the additional funds required for global

universal access above a two per cent levy would equal less than

USD2 billion globally, if all countries had completed the basic

reform agenda prior to launching access initiatives (Keremane

and Kenny, 2005).

Chile is a good example of what can be achieved with univer-

sal access programmes, with its system of auctioning subsidies

to pay for rural telecommunications rollout. In 1994, the country

set up a limited-life fund to support the provision of the first

payphones to remote and rural areas. Companies were asked to

bid for the lowest subsidy that they would accept to provide

service. Within two years, the fund had achieved 90 per cent of

its rollout objectives using only about half of its USD4.3 million

budget (Wellenius, 1997).

What role for donors?

It is worth noting that, in volume terms, international donors and

financial institutions have played a relatively small role in invest-

ments in ICI, with the great bulk of external financing to

developing country telecommunications sectors coming from

private flows. Having said that, it is important to note that donors

and international financial institutions can play both catalytic

and counter-cyclical roles. For example, during the post 2000

slowdown in private flows to developing market telecommuni-

cations companies, the IFC’s telecommunications investments

in Africa increased from an average of USD5.4 million between

1996 and 1999 to USD54.5 million between 2000 and 2003.

Each dollar of IFC

7

investment in the ICT sector attracted USD8.7

million of outside financing in 1999, and each USD1 000 of IFC

investment supported the rollout of an average of 14 new lines

(World Bank, 2002).

Within the World Bank Group alone, a large range of instru-

ments are available to support technical assistance, policy reform,

and investment in the area of ICI. The International Bank for

Reconstruction and Development and the International

Development Association have a number of instruments to provide

technical assistance and investment in the sector (investment loans,

but also development policy loans – quick-disbursing assistance

to support policy or institutional reforms in a sector or the economy

as a whole). Along with the IFC, the Multilateral Investment

Guarantee Agency promotes foreign direct investment by provid-

ing political risk insurance (guarantees) to investors and lenders,

and by helping emerging economies attract private investment. The

World Bank Group also administers programmes and trust funds

on behalf of donors, which can support technical assistance and

pilots. Examples include the Public-Private Infrastructure Advisory

Facility or InfoDev.

8

The World Bank Group fully recognizes the relevance of

modern information and communications services to poverty alle-

viation and sustainable development, and stands ready to

continue and increase its support to client countries in develop-

ing the ICI sector.

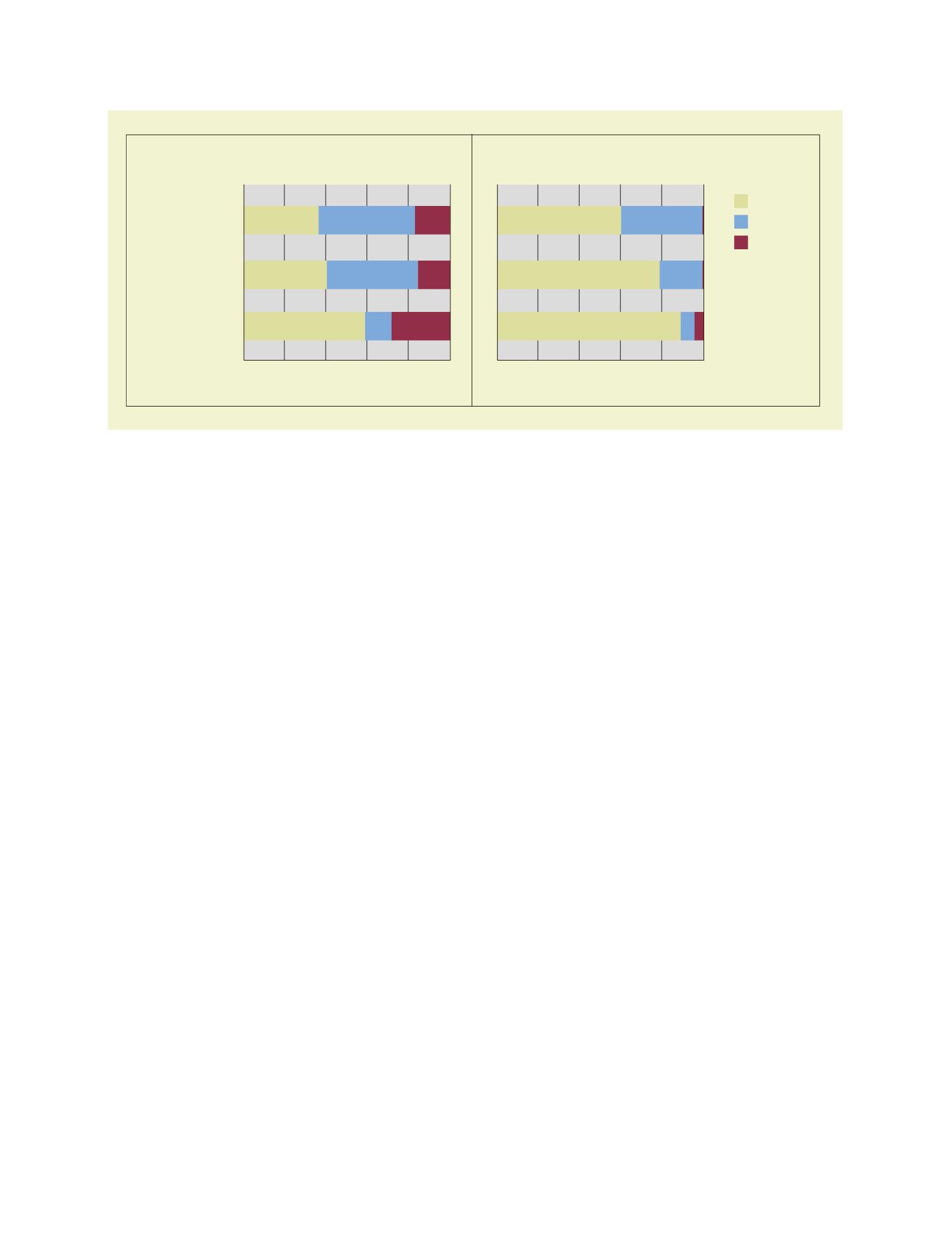

As % of Countries

As % of Population

Mobile

0% 20% 40% 60% 80% 100%

Fixed local

International

35

46

18

41

42

17

60

13.5 26.5

0% 20% 40% 60% 80% 100%

60.4

38.6

78

21.3

90

6

Not available

Monopoly

Competition

Figure 3: Level of telecommunications competition worldwide